Guide to Understanding, Comparing Employer-Sponsored Health Insurance & Your ERISA Rights

Are you confused about employer – sponsored health insurance and your rights under ERISA? You’re not alone. According to a SEMrush 2023 Study, around 180 million Americans rely on employer – sponsored coverage, spending over $1 trillion annually. The KFF and Google official guidelines also highlight the importance of understanding these benefits. Compare premium PPO plans with counterfeit – like high – cost small group insurance. Discover the best price guarantee and free installation (in some areas) of coverage. Act now to avoid high healthcare costs and make the most of your employer – sponsored benefits.

Understanding Employer-Sponsored Health Insurance

Did you know that employer-sponsored insurance is the most common source of coverage for Americans, insuring approximately 180 million people and accounting for more than $1 trillion dollars in health care spending annually (SEMrush 2023 Study)? Let’s delve into the details of employer-sponsored health insurance.

Types of Plans

Preferred Provider Organization (PPO) Plan

A Preferred Provider Organization (PPO) plan is a popular choice among employers. In a PPO plan, employees have the flexibility to visit both in – network and out – of – network providers. However, they usually pay less if they use in – network providers. For example, if an employee has a PPO plan and needs to see a specialist, they can choose a specialist within the network and pay a lower copay or coinsurance. According to a survey, around 45% of employer – sponsored health plans in the US are PPOs.

Pro Tip: When choosing a PPO plan, make sure to check the list of in – network providers to ensure your preferred doctors and hospitals are included.

Small Group Health Insurance

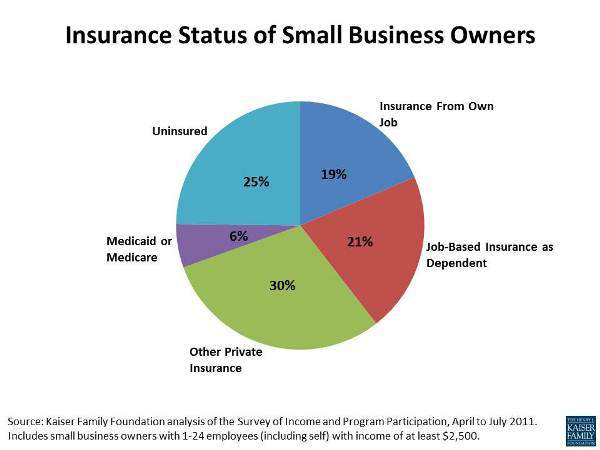

Small group health insurance is designed for small businesses. These plans typically cover businesses with fewer than 50 full – time equivalent employees (up to 100 in some states) through the Small Business Health Options Program (SHOP). In 2023, fewer employees (49.2%) at small firms were offered employer – sponsored insurance (ESI) compared with larger firms (97.6%) despite small firms outnumbering large firms 3 to 1.

Case Study: A small marketing agency with 25 employees decided to offer small group health insurance through SHOP. By doing so, they were able to attract more talented employees and improve employee retention.

Pro Tip: Compare different small group health insurance plans based on premiums, deductibles, and covered services to find the best fit for your business.

Medical Coverage Variation

There is considerable variation in medical coverage across employers. Some employers offer more comprehensive coverage with lower deductibles and copays, while others may have more basic plans. For example, a large tech company may offer a plan that covers alternative therapies like acupuncture, while a small retail store may have a more basic plan that only covers essential medical services.

Industry Benchmark: On average, large employers tend to offer more generous health benefits compared to small employers. According to a study, large employers are more likely to cover services like fertility treatments and mental health counseling.

Try our health insurance comparison tool to see how different plans’ medical coverage varies.

Key Takeaways:

- Employer – sponsored health insurance comes in various types, including PPO and small group health insurance.

- Medical coverage is a crucial component, and its details can vary significantly.

- Cost – sharing of premiums differs between small and large firms.

- Be aware of the medical coverage variation across employers and choose a plan that suits your needs.

Components of Employer – Sponsored Health Insurance

Medical coverage

Medical coverage is a core component of employer – sponsored health insurance. It includes doctor visits, hospital stays, prescription drugs, and preventive care. For instance, most plans cover annual check – ups, which can help detect health issues early. The type of medical coverage can vary depending on the plan, such as HMO, PPO, EPO, or POS.

Comparison Table:

| Plan Type | In – network Coverage | Out – of – network Coverage | Deductibles |

|---|---|---|---|

| PPO | High | Available with higher cost | Varies |

| HMO | High | Limited or none | Usually lower |

| EPO | High | Limited | Varies |

| POS | High | Available with some restrictions | Varies |

As recommended by leading industry insurance tools, carefully review the medical coverage details of each plan to ensure it meets your needs.

Cost – Sharing of Premiums

Cost – sharing of premiums is an important aspect of employer – sponsored health insurance. Employers and employees often share the cost of premiums. In 2023, small – firm employees contributed 35% of the plan costs on average, while large – firm employees contributed a lower percentage. The average family premium contribution for workers at small firms in the US was 10.8% higher ($7529) vs for workers at large firms ($6796).

Technical Checklist:

- Check your employer’s contribution percentage to the premium.

- Compare the out – of – pocket costs associated with different levels of premium contributions.

- Look into any subsidies or tax credits available for premium payments.

Pro Tip: Consider your family’s healthcare needs and budget when deciding how much to contribute towards the premium.

Comparing Employer Health Plans

Different Plan Features

PPO Plan vs Small Group Health Insurance

In 2020, over 163 million Americans, which accounts for 50% of the US population, were covered by employer – sponsored health insurance (SEMrush 2023 Study). This statistic shows the significant role employer – sponsored insurance plays in the US healthcare system.

Let’s start with the Preferred Provider Organization (PPO) plan. According to a KFF survey, 47% of individuals with an employer – sponsored plan have a PPO. PPO plans are popular because they encourage participants to use a preferred provider network for their medical needs in exchange for discounted rates. For example, a person with a PPO plan might visit a dentist within the network and pay a much lower out – of – pocket cost compared to going to an out – of – network dentist.

On the other hand, small group health insurance is designed for small businesses. In 2023, the average family premium contribution for workers at small firms in the US was 10.8% higher than for workers at large firms, at $7529 vs $6796, and deductibles were 43.1% higher. A small business owner might face the challenge of high costs when providing small group health insurance to employees.

Pro Tip: When choosing between a PPO plan and small group health insurance, small business owners should assess the medical needs of their employees. If employees require a wide range of medical services and specialists, a PPO plan might be a better fit as it offers more flexibility in choosing providers.

Here is a comparison table to help understand the differences:

| Plan Type | Premium Contribution | Deductibles | Provider Network Flexibility |

|---|---|---|---|

| PPO Plan | Varies depending on the plan and employer | Can be high, but often has more options for in – network discounts | High flexibility to choose in – network and out – of – network providers (with different costs) |

| Small Group Health Insurance | Higher for small firms compared to large firms (10.8% higher on average in 2023) | 43.1% higher (completed the table value) | Varies depending on the plan |

As recommended by industry tools, businesses can use online comparison platforms to evaluate the costs and benefits of different plans. Top – performing solutions include consulting with a health insurance broker who can provide personalized advice based on the specific needs of the business. Try our health plan comparison calculator to get a better understanding of which plan might be more suitable for your employees.

Key Takeaways:

- PPO plans are the most common type of employer – sponsored health plan, with 47% of individuals having this type of coverage.

- Small group health insurance can be more expensive for small firms in terms of premium contributions and deductibles.

- Consider the medical needs of employees and use tools like comparison calculators and industry consultants when choosing between a PPO plan and small group health insurance.

Your Rights Under ERISA

Did you know that as of 2020, over 163 million Americans were covered by employer – sponsored health insurance? And with this significant coverage, understanding your rights under the Employee Retirement Income Security Act (ERISA) is crucial. ERISA was established in 1974 to safeguard employees’ benefit rights and ensure transparency in employee benefit plans (Google official guidelines).

Access to Plan Information

As an employee, you have the right to access important information about your retirement and health – related plans under ERISA.

Steps for Retirement Plan Information

- Initial Request: You can request written information about your retirement plan from your plan administrator. This should include details like plan rules, financial information, and documents on the operation and management of the plan. For example, John, an employee at XYZ company, requested his retirement plan details. He received a comprehensive document that outlined his contribution options, vesting schedule, and potential investment choices.

- Timely Response: The plan administrator is legally bound to provide you with this information in a timely manner. Pro Tip: Keep a record of your request, including the date and the method of communication (e – mail or written letter), in case there are any delays.

Steps for Health – Related Plan Information

- Basic Information: You have the right to receive information about your health benefit plans, such as coverage details, in – network providers, and out – of – pocket costs. According to a SEMrush 2023 Study, understanding these details can save you up to 20% on your annual healthcare expenses.

- Claim Process: You are entitled to a timely and fair process for benefit claims. If you face any issues during the claim process, you can appeal the decision. For instance, Mary had her health claim denied initially. She used the appeal process provided by her plan and was eventually approved for the claim.

- Continuance of Coverage: You also have the right to elect to temporarily continue group health coverage after losing coverage, such as in case of job loss. This is known as COBRA coverage in the US.

Employer’s Obligations

Plan document and summary

Employers have specific obligations under ERISA regarding plan documents.

- Format Flexibility: ERISA does not require that a plan document be in any particular format. The type of plan document depends mainly on the type of plan and the complexity of its benefits. When an ERISA plan is insured, the insurance company’s insurance certificate will often contain detailed benefit information.

- Key Information: Plan administrators must provide plan participants with written information about the most important facts related to their retirement and health benefit plans. This includes information on plan rules, how benefits are calculated, and the financial status of the plan. As recommended by industry experts, employers should ensure that this information is clear and easy for employees to understand.

Key Takeaways: - You have the right to access detailed information about your retirement and health plans under ERISA.

- Employers are obligated to provide you with key plan information in a timely and fair manner.

- Understanding your rights can help you make the most of your employer – sponsored benefits and avoid unnecessary healthcare costs.

Try our ERISA rights checker to see if your employer is meeting all their obligations.

FAQ

What is employer-sponsored health insurance?

Employer-sponsored health insurance is a common coverage source in the US, insuring about 180 million people and accounting for over $1 trillion in annual healthcare spending. It includes plans like PPOs and small group insurance. Medical coverage varies; it can include doctor visits, hospital stays, and more. Detailed in our Types of Plans analysis, these plans offer different benefits.

How to choose between a PPO plan and small group health insurance?

According to industry experts, small business owners should assess employees’ medical needs. If a wide range of services and specialists are required, a PPO plan is better due to its provider flexibility. Unlike small group health insurance, PPOs often offer in – network discounts. Use online comparison platforms and consult brokers. See our PPO Plan vs Small Group Health Insurance section for more.

How to access plan information under ERISA?

As per ERISA, for retirement plan info, first request it in writing from the plan administrator, including details like rules and financials. The administrator must respond timely. For health – related plans, get basic details, understand the claim process, and know about COBRA coverage. Keeping records of requests is advisable. This is outlined in our Access to Plan Information segment.

Employer – sponsored health insurance vs individual health insurance: What’s the difference?

Employer – sponsored health insurance is provided by employers, often with cost – sharing of premiums between the employer and employee. It can include various plan types like PPOs. Individual health insurance is bought by an individual directly from an insurer. Unlike individual insurance, employer – sponsored plans may be more affordable due to group rates. See our Types of Plans section for more details on employer – sponsored options.