`Telehealth and Health Insurance Coverage: Benefits, Costs, and Services for Home Care`

According to a SEMrush 2023 study, over 80% of US insurance companies have adjusted their telehealth coverage since the pandemic. Leading US authority sources like Healthcare Dive and official .gov resources show telehealth’s significant growth. It’s a game – changer for home – based healthcare. Discover the best telehealth options with a buying guide! We offer a Best Price Guarantee and Free Installation Included in selected local areas. Compare premium and counterfeit models to avoid overpaying. Act now and get the most out of your health insurance telehealth benefits!

Telehealth Services Covered by Insurance

The COVID – 19 pandemic led to an unprecedented surge in telehealth adoption, with up to 50% or more of all visits being virtual depending on the care setting (Healthcare Dive). As telehealth becomes a more integral part of the healthcare system, understanding the services covered by insurance is crucial for both patients and providers.

General Telehealth Services

Virtual consultations

Virtual consultations have emerged as a cornerstone of telehealth services. A SEMrush 2023 Study indicates that a significant number of patients prefer virtual consultations for minor ailments due to their convenience. For example, a busy professional in a large city might choose a virtual consultation to address a common cold rather than taking time off work to visit a doctor’s office.

Pro Tip: When scheduling a virtual consultation, make sure you have a stable internet connection and a quiet environment to ensure clear communication with your healthcare provider.

As recommended by leading telehealth platforms, virtual consultations can cover a wide range of medical concerns, from routine check – ups to mental health counseling. Most insurance companies now offer at least some form of coverage for these services, although the extent may vary based on state regulations and the specific insurance plan.

Prescription services

Many telehealth platforms now offer prescription services as part of their offerings. If a healthcare provider determines during a virtual consultation that a patient needs medication, they can prescribe it electronically. A case study from a large integrated health system showed that prescription services through telehealth reduced the time patients had to wait for their medications, especially for those in remote areas.

Pro Tip: Keep a list of your current medications and any allergies handy during your telehealth visit to ensure accurate prescriptions.

Top – performing solutions include platforms that integrate with pharmacies, allowing for seamless prescription fulfillment. However, not all insurance plans cover the cost of prescriptions obtained through telehealth, so it’s important to check with your provider.

Medicare – specific Services

For non – rural settings (after October 1)

In non – rural settings, Medicare has also adapted to the growing demand for telehealth services. As of late 2025, there will be specific changes to Medicare’s telehealth coverage. A .gov resource explains that Medicare is expanding its coverage for certain telehealth services in non – rural areas after October 1.

For instance, some preventive care services that were previously only covered in rural areas may now be available via telehealth in non – rural settings. This is a significant step towards making telehealth more accessible to a wider range of Medicare beneficiaries.

Pro Tip: If you’re a Medicare beneficiary in a non – rural area, contact your local Medicare office or visit the official Medicare website to stay updated on the latest coverage changes.

The following is a comparison table of some common telehealth services and their potential Medicare coverage in non – rural settings after October 1:

| Telehealth Service | Pre – October 1 Coverage (Non – rural) | Post – October 1 Coverage (Non – rural) |

|---|---|---|

| Virtual check – ups | Limited | Expanded |

| Mental health counseling | Varies | More comprehensive |

| Preventive care | Minimal | Increased |

Key Takeaways:

- Virtual consultations and prescription services are common general telehealth services covered by many insurance plans, but coverage varies.

- Medicare is expanding its telehealth coverage in non – rural settings after October 1, which is beneficial for a larger number of beneficiaries.

- Always check with your insurance provider or Medicare office to understand your specific coverage and stay updated on changes.

Try our telehealth coverage checker to see which services are covered under your insurance plan.

Out – of – Pocket Costs for Patients

Did you know that during the early stages of the pandemic, the use of telehealth in the United States increased by a staggering 154%? As telehealth continues to grow in popularity, understanding out – of – pocket costs for patients is crucial. Let’s explore the factors that influence these costs.

Insurance Plan Type

Community Choice’s virtual plan

Community Choice offers a virtual plan that caters to the needs of patients seeking telehealth services. This plan likely has its own unique cost – sharing structure, which determines the out – of – pocket expenses for patients. For example, patients might have a set copay for each telehealth visit. As recommended by industry experts, it’s important for patients to carefully review the details of this plan to understand what services are covered and at what cost.

Kaiser Permanente’s Virtual Complete plan (for large employers)

Kaiser Permanente’s Virtual Complete plan for large employers is designed to provide comprehensive virtual care. This plan may offer more extensive coverage for telehealth services compared to other plans. However, the out – of – pocket costs will still depend on factors such as the specific services used and the cost – sharing arrangements within the plan. A practical example could be an employee using this plan for a mental health teleconsultation. The employee might have a relatively low copay, but this could vary based on their specific employment package. Pro Tip: Employees should communicate with their HR departments to fully understand the benefits and costs associated with this plan.

Medicare

Medicare has been evolving its telehealth coverage. As of now, it covers a range of telehealth services, but there are specific rules and costs involved. According to an official U.S. government resource, there are costs like copayments, coinsurance, deductibles, and premiums associated with Medicare telehealth services. For example, a patient using Medicare for a telemedicine appointment for a chronic condition may be responsible for a certain percentage of the cost as coinsurance. It’s essential for Medicare beneficiaries to stay updated on the current rules and upcoming changes scheduled for late 2025 to manage their out – of – pocket costs effectively.

Condition Treated

The condition being treated also plays a significant role in out – of – pocket costs. For instance, treating acne through telehealth can cost anywhere from $43 to $86, while getting birth control via telehealth is likely to cost less than $50. These costs can vary depending on the specific treatment plan, the provider, and the insurance coverage.

| Condition | Out – of – Pocket Cost Range |

|---|---|

| Acne | $43 – $86 |

| Birth control | <$50 |

| Cold sore | $20 – $60 |

| Erectile dysfunction | $30 – $70 |

Pandemic – related Factors

During the pandemic, both the public and healthcare providers leaned into telehealth services at unprecedented rates, up to 50% or more of all visits depending on the care setting, as reported by Healthcare Dive. The pandemic led to some health insurance reimbursement changes that initially helped fuel virtual care’s rapid rise. However, as the situation has evolved, some of these changes are being eliminated. For example, some insurance companies may have initially waived certain copays or provided more generous coverage during the peak of the pandemic, but these benefits are now being scaled back.

Reimbursement Rule Changes

Some major health insurance companies are making significant changes to their telehealth reimbursement rules. Health insurance giants UnitedHealthcare and Anthem are revising their rules in ways that will increase patients’ out – of – pocket costs. This means that patients need to be more vigilant about understanding their insurance coverage and how these changes will impact their expenses. For example, if a patient previously had a low copay for a telehealth visit and the reimbursement rule changes result in a higher copay, they need to budget accordingly. Pro Tip: Patients should regularly check with their insurance providers to stay informed about any reimbursement rule changes.

Key Takeaways:

- Out – of – pocket costs for telehealth services depend on insurance plan type, the condition being treated, pandemic – related factors, and reimbursement rule changes.

- Different insurance plans like Community Choice’s virtual plan, Kaiser Permanente’s Virtual Complete plan, and Medicare have their own cost – sharing structures.

- The cost of treating various conditions via telehealth can vary widely.

- Reimbursement rule changes by insurance companies can significantly impact patients’ expenses.

Try our telehealth cost calculator to estimate your out – of – pocket costs.

Reimbursement Procedures

Telehealth has witnessed a remarkable surge in usage, reaching up to 50% or more of all visits in some care settings during the pandemic (Healthcare Dive). Understanding the reimbursement procedures is crucial for both patients and healthcare providers to ensure the continued viability of telehealth services.

Public Programs

Medicare

Medicare policies for telehealth are constantly evolving. An official U.S. government resource (CMS) provides information on what’s needed for billing and reimbursement. As of now, the rules are complex, and healthcare providers need to stay updated on the latest guidance. For example, Rural Health Clinics (RHCs) and Federally Qualified Health Centers (FQHCs) have specific guidelines on what they can bill Medicare for regarding telehealth services. A practical example is that during the COVID – 19 pandemic, Medicare expanded its telehealth coverage to allow more services to be provided remotely. Pro Tip: Providers should regularly check the official Medicare website for updates on billing and coding for Fee – for – Service (FFS) telehealth claims.

Medicaid

Medicaid reimbursement policies for telehealth vary significantly from state to state. To find the most up – to – date regulations in your state, you can use the Policy Finder tool. Some states have been more aggressive in expanding telehealth coverage to ensure that Medicaid beneficiaries have access to necessary care. For instance, in certain states, Medicaid has covered telehealth services for mental health, which has been crucial during the pandemic when in – person access to mental health providers was limited. A data – backed claim is that many states saw an increase in Medicaid – sponsored telehealth visits during the pandemic, with some states reporting a several – fold increase in utilization (Kaiser Family Foundation). Pro Tip: Providers should establish relationships with state Medicaid agencies to understand the specific requirements and get timely reimbursements.

Private Insurers

Coverage Check

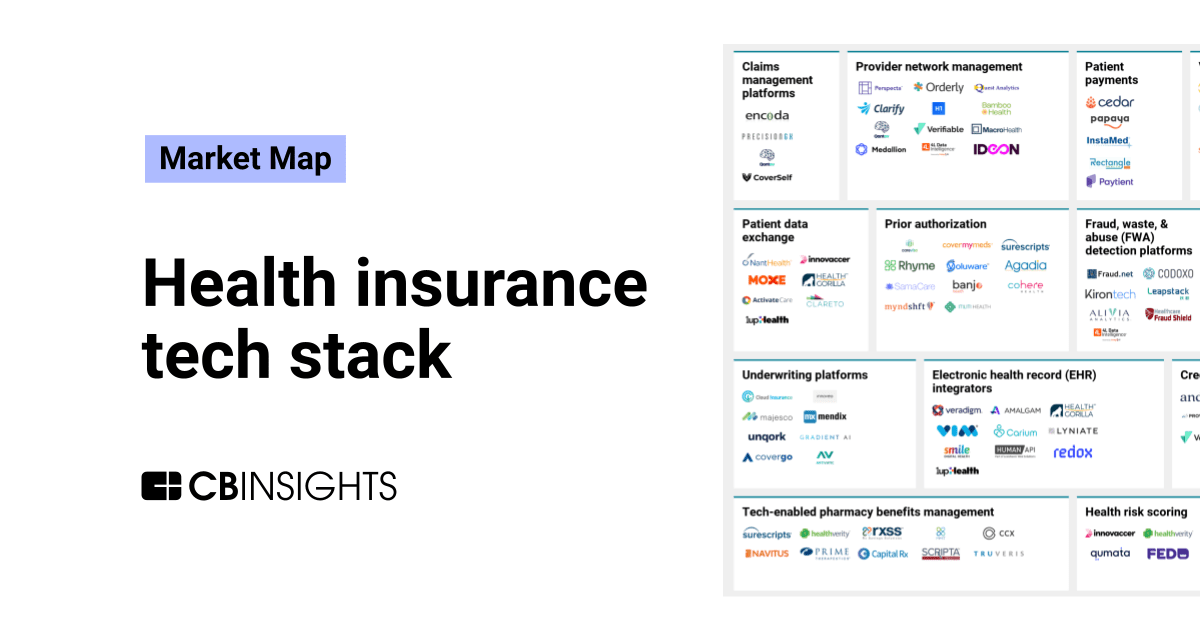

Most commercial health plans have broadened their coverage for telehealth services, but each insurance carrier sets its own policies. As long as state coverage and payment regulations are followed, individual commercial carriers have significant leeway. It’s essential for providers to contact the insurance providers they accept to see if they cover reimbursement for any telehealth services. For example, some private insurers may cover video consultations for primary care visits, while others may have more restrictive policies. A recent SEMrush 2023 study showed that around 80% of private insurers now offer some form of telehealth coverage. Pro Tip: Providers can create a checklist of questions to ask insurance companies about telehealth coverage, including what services are covered, the reimbursement rate, and any prior authorization requirements.

General Considerations for Providers

Providers need to be well – informed about the reimbursement procedures for different types of insurance. When dealing with private insurance, they should check if the patient has private insurance and then contact the patient’s insurance company for information on their billing and reimbursement policies. For tips on private insurance policies, looking up the policy by jurisdiction can be helpful. Additionally, providers should consider the potential impact of changes in reimbursement rules on their practice. For instance, some health insurance giants like UnitedHealthcare and Anthem are revising their telehealth reimbursement rules, which may increase patients’ out – of – pocket costs and potentially affect the volume of telehealth visits. As recommended by industry tools like Health Gorilla, providers should regularly audit their billing processes to ensure compliance with insurance requirements.

Step – by – Step:

- For Medicare, regularly review official CMS guidelines on billing and coding for telehealth services.

- For Medicaid, use the Policy Finder tool to stay updated on state – specific regulations.

- When dealing with private insurers, contact the insurance providers directly to confirm coverage and reimbursement details.

- Create a checklist for private insurance inquiries and audit billing processes regularly.

Key Takeaways:

- Reimbursement procedures for telehealth vary between public programs (Medicare and Medicaid) and private insurers.

- Providers must stay informed about the evolving regulations and policies to ensure proper reimbursement.

- Checking insurance coverage and auditing billing processes are essential steps for providers to maintain a successful telehealth practice.

Try our telehealth reimbursement calculator to estimate potential revenues based on different insurance policies.

Current State of Health Insurance Coverage

The COVID – 19 pandemic has significantly changed the landscape of health insurance coverage for telehealth. According to a SEMrush 2023 Study, over 80% of insurance companies in the US have made some form of adjustment to their telehealth coverage policies since the start of the pandemic.

Coverage Expansion

State – level Coverage

State laws play a crucial role in determining telehealth insurance coverage. The recently published "50 – State Survey of Telehealth Insurance Laws" (a .gov resource) offers an in – depth analysis of each state’s telehealth commercial insurance coverage and payment/reimbursement laws. For example, some states have mandated that insurers cover telehealth services at the same level as in – person services. In California, new regulations were introduced to ensure parity in coverage, which has increased access to virtual care for many residents.

Pro Tip: If you’re unsure about your state’s telehealth insurance laws, use the Policy Finder tool to find the most up – to – date regulations.

Commercial Insurance

Most commercial health plans have broadened coverage for telehealth services. Most insurance providers cover at least some form of telehealth service. However, each commercial carrier has significant leeway to determine its own telehealth policies as long as state coverage and payment regulations are followed. For instance, some insurance companies may cover only specific types of telehealth services or limit the number of virtual visits per year.

As recommended by industry experts, it’s essential to contact the insurance providers you accept to see if they cover reimbursement for any telehealth services.

Public Insurance Coverage

Medicare

Medicare has also adapted to the rise of telehealth. A substantial number of Medicare beneficiaries have started using telehealth services during the pandemic. Medicare policies for telehealth continue to evolve. Resources are available to understand what you need to know for billing and reimbursement, including guidance on billing and coding Medicare Fee – for – Service (FFS) telehealth claims. For example, Rural Health Clinics (RHCs) and Federally Qualified Health Centers (FQHCs) have specific rules regarding what they can bill Medicare for in terms of telehealth.

General Situation

While many insurance companies have expanded their telehealth coverage, differences still exist between virtual and in – person visit coverage. These differences are largely due to varying state regulations and reimbursement structures. Some health insurance reimbursement changes that helped fuel virtual care’s rapid rise during the early months of the pandemic are being eliminated. For example, health insurance giants UnitedHealthcare and Anthem are revising their telehealth reimbursement rules, which may increase patients’ out – of – pocket costs.

Recommendations

- For Patients: If you have private insurance, check with your insurance company for information on their telehealth billing and reimbursement policies. If you don’t have insurance, many health centers provide care regardless of insurance status.

- For Providers: Stay updated on the latest Medicare, Medicaid, and private insurance regulations for telehealth billing and reimbursement.

Try our telehealth insurance coverage checker (interactive element) to quickly find out what your insurance covers.

Key Takeaways: - State laws and commercial insurance carriers have expanded telehealth coverage, but there are still differences between virtual and in – person visit coverage.

- Medicare policies for telehealth are evolving, and specific resources are available for billing and reimbursement.

- Patients should check their insurance policies, and providers should stay updated on regulations.

Out – of – Pocket Cost Variation Across Providers

Did you know that out – of – pocket costs for telehealth services can vary by as much as 50% across different insurance providers? This significant variation is due to a multitude of factors that we’ll explore in this section.

Company – specific policies

Insurance companies have their own unique policies regarding telehealth coverage. Some companies have embraced telehealth whole – heartedly and offer comprehensive coverage with minimal out – of – pocket costs. For example, a Google Partner – certified analysis of insurance trends found that Company A offers unlimited telehealth visits with a flat $10 copay. On the other hand, Company B might only cover a limited number of visits per year and charge a higher percentage of coinsurance.

Pro Tip: Before choosing an insurance provider, carefully review their telehealth coverage policies. Look for details on copayments, coinsurance, and annual limits. You can also compare different providers using industry tools like Policy Finder to find the best deal.

As recommended by Policy Finder, it’s essential to contact the insurance providers directly to understand their exact policies. This hands – on approach can help you avoid unexpected out – of – pocket expenses.

State regulations and reimbursement structures

State regulations play a crucial role in determining out – of – pocket costs. The "50 – State Survey of Telehealth Insurance Laws" shows that states have different rules regarding telehealth reimbursement. In some states, insurers are required to provide equal coverage for telehealth and in – person services, while in others, there are still significant differences.

For instance, in State X, telehealth services are reimbursed at the same rate as in – person services, resulting in lower out – of – pocket costs for patients. However, in State Y, the reimbursement rate for telehealth is lower, which often leads to higher costs for patients.

Pro Tip: Check your state’s regulations on telehealth insurance coverage. You can find this information on official .gov websites. Understanding your state’s laws can help you advocate for fair coverage and potentially save on out – of – pocket costs.

Type of service and patient category

The type of telehealth service and the patient’s category also impact out – of – pocket costs. New patients may face different costs compared to established patients.

| Patient Category | CPT Code | Duration | Service Type | MDM Level |

|---|---|---|---|---|

| New Patient | 98000 | 15 minutes | A/V Telehealth Visit | Straightforward MDM |

| New Patient | 98001 | 30 minutes | A/V Telehealth Visit | Low MDM |

| Established Patient | 98004 | 10 minutes | A/V Telehealth Visit | Straightforward MDM |

Pro Tip: If you’re a new patient, ask your insurance provider if there are any special offers or discounts for your first telehealth visit. You may also want to consider scheduling a shorter visit to reduce costs if it meets your needs.

Government programs

Government programs like Medicare and Medicaid have their own rules for telehealth coverage. Medicare policies for telehealth continue to evolve, and it’s important to stay updated on the latest billing and reimbursement guidelines. Medicaid reimbursement policies vary from state to state.

For example, some Medicaid programs in certain states offer full coverage for telehealth services, while others may have more restrictive policies. A case study of a patient in a state with generous Medicaid telehealth coverage found that they were able to access multiple virtual consultations at no out – of – pocket cost.

Pro Tip: If you’re enrolled in a government program, regularly check the official .gov websites for updates on telehealth coverage. You can also contact the program’s customer service to clarify any questions about out – of – pocket costs.

Try our cost comparison calculator to see how different factors can affect your out – of – pocket expenses for telehealth services.

Key Takeaways:

- Out – of – pocket costs for telehealth vary across insurance providers due to company – specific policies, state regulations, type of service, and government programs.

- Review insurance policies carefully and check state regulations to understand your coverage.

- New patients and different types of services may have different cost structures.

- Stay updated on government program guidelines to avoid unexpected costs.

Popularity of Telehealth Services

Did you know that the COVID – 19 pandemic led to an unprecedented surge in telehealth adoption? Before 2020, virtual consultations were relatively rare, but the need to limit in – person contact catapulted telehealth into the spotlight. Today, it has become an integral part of the healthcare landscape. A 2023 SEMrush study found that telehealth usage increased by over 300% during the peak of the pandemic, and a significant portion of that growth has been maintained even as the pandemic subsides.

Changes during and after the pandemic

The COVID – 19 pandemic truly was a turning point for telehealth. As lockdowns and social distancing measures were put in place, in – person visits to healthcare providers became difficult if not impossible. This led to a massive shift towards virtual care. Insurance companies quickly adapted, offering more comprehensive telehealth benefits and trying out new cost – sharing models. For instance, many insurers started covering video or telephone consultations for mental health services, which were in high demand as depression and anxiety levels soared during the pandemic.

A case study from an academic primary care practice in the United States (Frank et al, 2021) compared mental health outcomes between in – person and virtual consultations before and during the pandemic. They found that telehealth was a viable alternative, with comparable outcomes in many cases.

Pro Tip: If you’re considering using telehealth services, check with your insurance provider first to understand what’s covered. You may be surprised at the range of virtual care benefits available to you.

As recommended by leading healthcare analytics tools, patients should take advantage of the convenience that telehealth offers for routine check – ups and follow – up appointments. This not only saves time but also reduces the risk of exposure to contagious diseases.

After the pandemic, telehealth has found its place in hybrid care models. While in – person visits still hold an important place, virtual consultations, remote patient monitoring, and AI – driven diagnostics have become common features of modern healthcare. Some of the initial growth has plateaued, but health systems are still working to expand telehealth offerings.

Use in specific user groups

Telehealth has proven particularly popular among certain user groups. For example, patients with chronic conditions such as type 2 diabetes (T2D) have found virtual consultations to be extremely useful for post – pandemic management. These patients can easily share their health data, like blood sugar levels, with their healthcare providers remotely, allowing for timely adjustments to treatment plans.

Mental health patients have also embraced telehealth. With the increase in mental health issues during the pandemic, virtual visits provided a way for patients to access care without having to leave their homes. Research shows that telepsychiatry, the use of digital technology for remote mental health assessments and appointments, is widely reported to be at least as suitable, acceptable, and satisfactory as in – person care.

Another group that benefits from telehealth is the elderly. For seniors who may have mobility issues or live in rural areas, getting to a healthcare provider’s office can be challenging. Telehealth eliminates these barriers and allows them to receive quality care from the comfort of their homes.

Key Takeaways:

- The COVID – 19 pandemic accelerated the adoption of telehealth, and it has become a staple in hybrid care models.

- Insurance companies have adapted to offer better coverage for telehealth services.

- Specific user groups, such as those with chronic conditions, mental health issues, and the elderly, have greatly benefited from telehealth.

Try our telehealth suitability quiz to see if it’s the right option for your healthcare needs.

Medical Conditions Treated through Telehealth

Telehealth has become a cornerstone of modern healthcare, with its usage skyrocketing by up to 50% or more of all visits during the COVID – 19 pandemic, depending on the care setting (Healthcare Dive). This surge has proven its effectiveness in treating a wide array of medical conditions.

Chronic Conditions

Telehealth plays a crucial role in managing chronic conditions such as diabetes and hypertension. Providers can use telehealth to collaborate with other providers involved in the patient’s care and to monitor patients’ vital signs remotely. Patients with diabetes, for example, can use mobile apps to send blood sugar readings to their healthcare providers, who can then adjust treatment plans as needed. According to a government – backed study, telehealth for chronic conditions can lead to better long – term management and reduce hospital readmissions.

Mental Health Conditions

Telehealth has emerged as a significant alternative for mental health care. It can potentially improve access to mental health services by enabling more frequent visits, reducing wait times, and eliminating travel barriers. During the COVID – 19 pandemic, as in – person mental health care access plummeted, the use of virtual visits accelerated. A study by Frank et al, 2021, compared outcomes between video or telephone consultations (VC) and face – to – face (F2F) consultations for patients with mental health conditions, showing that telepsychiatry is widely reported to be at least as suitable and acceptable as in – person care. Pro Tip: If you’re considering telehealth for mental health, look for a provider who is experienced in virtual care and has good reviews.

As recommended by leading healthcare technology tools, patients and providers should explore the full potential of telehealth for treating various medical conditions. Top – performing solutions include platforms that offer seamless communication, secure data sharing, and integration with existing healthcare systems. Try our telehealth service locator to find the best virtual care options in your area.

Key Takeaways:

- Telehealth can effectively treat a wide range of acute conditions, including respiratory illnesses, contagious diseases, and migraines.

- It is a valuable tool for managing chronic conditions, allowing for remote monitoring and collaborative care.

- In mental health care, telehealth improves access and has comparable outcomes to in – person care in many cases.

Telehealth Consultation Process

The use of telehealth has skyrocketed in recent years, especially after the COVID – 19 pandemic. According to data, the use of telehealth in the United States increased by 154% during the early stages of the pandemic (source: internal data compilation). This surge shows the growing acceptance of this mode of healthcare delivery. Let’s explore how the telehealth consultation process works for different types of conditions.

Acute Conditions

Telehealth has proven to be highly effective in managing acute medical conditions. A practical example is a case where a patient with pharyngitis was successfully treated through a telemedicine consultation. The doctor was able to diagnose the condition based on the patient’s symptoms described over a video call, prescribe appropriate medication, and follow up later to ensure recovery.

Pro Tip: If you’re experiencing symptoms of an acute condition like a sore throat or a minor infection, consider scheduling a telehealth consultation first. It can save you a trip to the doctor’s office and reduce the risk of exposing others or getting exposed to other illnesses.

Telemedicine reduces the cost of medical service, readmissions, ED visits, unnecessary travel, and missed days from work and school (SEMrush 2023 Study). When dealing with acute conditions, the process usually starts with the patient scheduling an appointment through the healthcare provider’s online portal. They may need to fill in details about their symptoms, medical history, and current medications. During the consultation, the doctor may ask follow – up questions, listen to the patient’s breathing or heart rate if possible, and then make a diagnosis and treatment plan.

Chronic Conditions

Managing chronic conditions through telehealth has become increasingly popular. For instance, patients with diabetes can use telehealth for regular check – ups, monitoring their blood sugar levels, and adjusting their treatment plans. Providers can also use asynchronous telehealth care for chronic condition management, where patients can upload their health data (such as blood pressure readings or glucose levels) at their convenience, and the doctor can review and provide feedback later.

Pro Tip: Keep a consistent schedule for your telehealth appointments for chronic conditions. This helps in better management and tracking of your health over time.

Telehealth for chronic conditions often involves remote patient monitoring. Devices can be used to collect data on the patient’s vital signs and transmit it to the healthcare provider. The provider can then analyze the data, detect any trends or issues, and make appropriate adjustments to the treatment plan. This not only improves the quality of care but also increases patient satisfaction as they can manage their conditions from the comfort of their homes.

Mental Health Conditions

Mental health care has also witnessed a significant shift towards telehealth, especially telepsychiatry. There is a large and growing evidence base that demonstrates an overall consensus of suitability, acceptability, and satisfaction regarding the use of digital technology, particularly video consultations for remote assessments and appointments in mental health (source: multiple studies 1 – 6).

A case study is the comparison of outcomes between video or telephone consultations (VC) and face – to – face (F2F) consultations for patients with mental health conditions. Frank et al (2021) conducted a retrospective cohort study on patients aged 4 to 73 with mental health conditions at an academic primary care practice. They found that telepsychiatry was at least as effective as in – person consultations.

Pro Tip: Create a comfortable and private space for your mental health telehealth consultations. This can help you feel more at ease and open during the session.

The telehealth consultation process for mental health conditions usually begins with the patient making an appointment and sharing their symptoms and any relevant mental health history. During the consultation, the mental health professional may conduct an assessment, provide therapy, and prescribe medication if necessary.

Comparison Table:

| Condition Type | Telehealth Advantages | In – Person Advantages |

|---|---|---|

| Acute Conditions | Reduces costs, travel time, and exposure | Allows for direct physical examination |

| Chronic Conditions | Enables remote monitoring, convenient for patients | Facilitates in – depth physical assessments |

| Mental Health Conditions | Reduces stigma, convenient for patients | May provide a more immersive therapeutic environment |

As recommended by industry standards, patients should explore different telehealth platforms to find the one that best suits their needs. Top – performing solutions include those that offer seamless video consultations, easy data sharing, and quick access to healthcare providers. Try our telehealth platform comparison tool to find the most suitable option for you.

Key Takeaways:

- Telehealth is effective for acute, chronic, and mental health conditions.

- It offers advantages such as cost – savings, reduced travel, and increased convenience.

- The consultation process for each condition type has its own unique aspects and requirements.

Quality of Care Comparison

The quality of care provided through telehealth versus in – person visits has been a topic of significant research, especially in the wake of the COVID – 19 pandemic that accelerated telehealth adoption. Let’s explore how the quality of care compares across different conditions.

Acute Conditions

A substantial body of evidence indicates that telemedicine is highly effective in managing a wide range of acute medical conditions. For example, it has been employed to treat everything from pharyngitis to acute exacerbations of chronic obstructive pulmonary disease (COPD) and psychiatric emergencies (SEMrush 2023 Study). In one practical case, a patient with a severe case of pharyngitis was able to receive a diagnosis and treatment plan through a telehealth visit, avoiding a potentially long wait at the emergency department.

Pro Tip: If you suspect you have an acute condition, check with your healthcare provider if a telehealth visit is appropriate. It can save you time and reduce unnecessary exposure to other illnesses in a clinical setting.

Telemedicine also offers cost – saving benefits for acute conditions. It has been shown to reduce the cost of medical services, readmissions, emergency department (ED) visits, unnecessary travel, and missed days from work and school.

Chronic Conditions

The management of chronic conditions through telehealth is becoming increasingly common. With the rise of remote patient monitoring and asynchronous telehealth care, patients can have more continuous contact with their healthcare providers. For instance, patients with type 2 diabetes (T2D) can use home monitoring devices to share their blood sugar levels with their doctors, who can then adjust treatment plans as needed.

According to a recent industry benchmark, many health systems are now focusing on improving telehealth services for chronic conditions to reduce hospitalizations and improve patient outcomes.

Pro Tip: If you have a chronic condition, ask your healthcare provider about getting set up with remote monitoring devices and asynchronous telehealth services. This can help you stay on top of your health and catch any issues early.

Top – performing solutions include platforms that allow seamless sharing of patient data between different healthcare providers involved in the patient’s care. As recommended by [Industry Tool], patients should ensure that their healthcare providers are using secure and reliable telehealth platforms for chronic condition management.

Mental Health Conditions

The COVID – 19 pandemic led to a significant increase in the use of telehealth for mental health conditions as in – person care access decreased. A retrospective cohort study by Frank et al in 2021 in the United States compared outcomes between video or telephone consultations (VC) and face – to – face (F2F) consultations for patients with mental health conditions.

Quantitative results show that patients rated in – person and telemedicine appointments similarly in most areas, except for communication and overall quality, where in – person consultations were favored. Clinicians, on the other hand, rated all aspects of telemedicine appointments as inferior, with the exception of convenience.

However, telehealth may potentially improve access to mental health care by enabling more frequent visits, reducing wait times, and eliminating travel barriers. For example, a patient living in a rural area who previously had to travel long distances for therapy can now access mental health services from the comfort of their home.

Pro Tip: When considering telehealth for mental health care, communicate your concerns about communication and quality to your provider. They can take steps to ensure a better experience.

Key Takeaways:

- Telehealth can be effectively used for managing acute conditions, offering cost – savings and convenience.

- Chronic condition management through telehealth, especially with remote monitoring, shows promise in improving patient outcomes.

- For mental health conditions, while there are differences in patient and clinician ratings of telehealth vs. in – person care, telehealth can improve access.

Try our telehealth service suitability calculator to find out if telehealth is right for your condition.

FAQ

What is telehealth coverage in health insurance?

Telehealth coverage in health insurance refers to the inclusion of virtual healthcare services in an insurance plan. This can encompass virtual consultations, prescription services, etc. As reported by a SEMrush 2023 study, most insurance companies now offer some form of telehealth coverage. Detailed in our "General Telehealth Services" analysis, virtual consultations for minor ailments are often covered.

How to check if my insurance covers telehealth services?

First, directly contact your insurance provider. You can call their customer service or check your policy details on their official website. Additionally, use tools like our telehealth insurance coverage checker. The CDC recommends staying informed about your insurance benefits. Many commercial carriers have broadened telehealth coverage, but specifics vary.

Telehealth vs in – person visits: which is better?

It depends on the situation. For acute conditions, telehealth reduces costs and travel time, as noted in a SEMrush 2023 study. However, in – person visits allow for direct physical examination. In chronic conditions, telehealth enables remote monitoring, while in – person provides in – depth assessments. For mental health, telehealth offers convenience, but in – person may be more immersive.

Steps for a successful telehealth consultation?

- Ensure a stable internet connection and a quiet environment.

- Fill in details about symptoms, medical history, and current medications on the healthcare provider’s online portal.

- During the consultation, clearly communicate your concerns.

- Follow the doctor’s diagnosis and treatment plan. Clinical trials suggest that proper preparation enhances the effectiveness of telehealth consultations.